The US Federal Reserve implemented an expected 0.25% interest rate hike last week, potentially marking the culmination of its historic tightening cycle. As inflation subsides and the risks of recession and slowed growth loom, future projections anticipate rate cuts later in the year.

Similarly, the European Central Bank raised its key rates by 0.25%, displaying a particularly hawkish stance. With subsequent increases anticipated in the coming months, the ECB's tightening cycle began later and from a lower starting point.

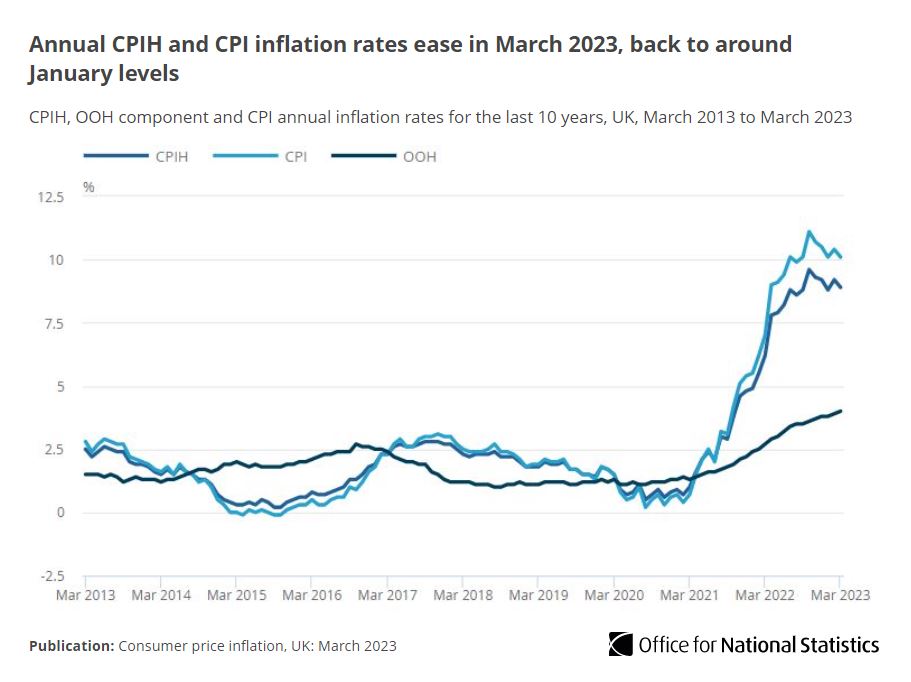

Looking ahead, the Bank of England is scheduled to announce its decision this week, with market expectations pointing towards a 0.25% increase, resulting in a 4.50% interest rate. The vote on this matter is likely to be divided. Analyst opinions diverge on whether this hike will be the final one or if rates will continue to rise as conflicting economic signals persist.

The upcoming week holds significant economic data, including UK growth figures and the latest US inflation numbers, which will contribute to market volatility.

Concerns about the stability of the US banking system and escalating worries regarding the debt ceiling exert a negative influence on market sentiment.

Regarding currency exchanges, the weakening US dollar remains the primary driving force. As the Federal Reserve reaches the peak of its interest rate trajectory and concerns about the banking system persist, the interest rate differentials between currencies continue to diminish. These factors contribute to the British pound surging to its highest level of the year, surpassing the 1.2600 threshold.

Finally, very many congratulations from the Monfor team to His Majesty, King Charles III on a fantastic coronation.