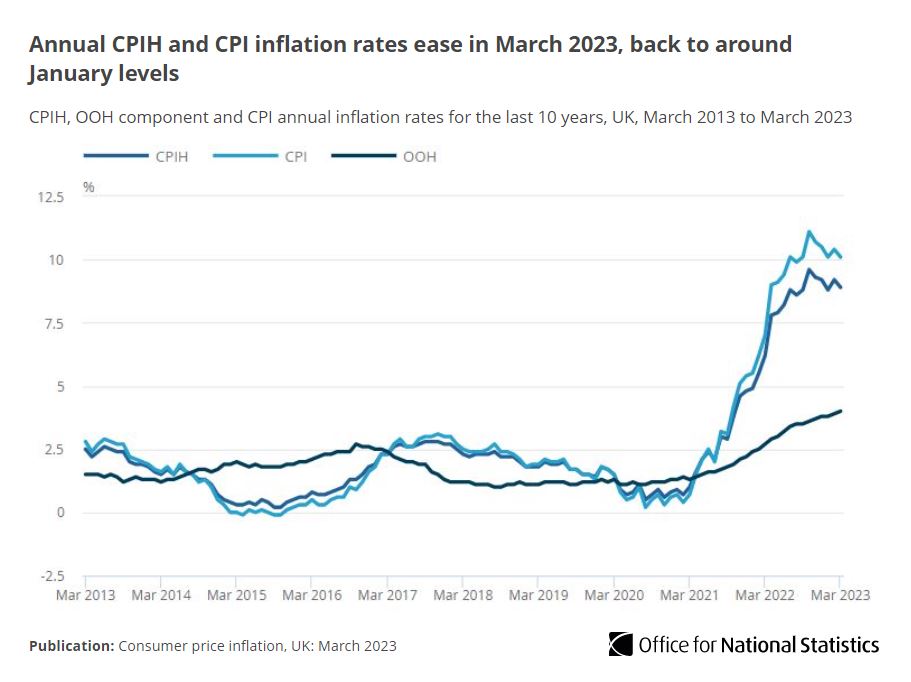

According to official data released on Wednesday, Britain was the only country in Western Europe to experience double-digit inflation in March, as it fell less than expected. The Office for National Statistics (ONS) reported that consumer price inflation (CPI) dropped to an annual rate of 10.1%, down from 10.4% in February, but still well above the economists' forecast of 9.8% and the Bank of England's (BoE) prediction of 9.2% in February.

The persistently high inflation, which reached a 41-year peak of 11.1% in October, is eroding the purchasing power of workers whose salaries are rising at a slower pace. In March, prices for food and non-alcoholic beverages were 19.1% higher than a year ago, the largest such increase since August 1977, due to higher costs of biscuits, cakes, milk, sugar, and to a lesser extent, chocolate and fruit.

The data highlighted concerns that Britain could experience prolonged inflation compared to its counterparts due to its dependence on natural gas for energy and electricity, as well as the structure of government subsidies that smoothed out price fluctuations.

Furthermore, the Bank of England is apprehensive that persistent inflation could trigger long-term wage demands and businesses' pricing strategies, further compounded by a decline in the labor force after the pandemic and trade and labor market frictions caused by Brexit.

Although core inflation, which excludes volatile food and energy prices, was expected to fall, it remained unchanged at 6.2%. Similarly, services inflation, which the BoE considers a proxy for domestic price pressures, also remained constant at 6.6%. As a result, the data strengthened expectations that the Bank of England would raise interest rates again in May.