Market Turmoil as US Tariffs on Canada and Mexico Move Forward

Global markets experienced significant turbulence overnight after US President Donald Trump confirmed that new tariffs on Canada and Mexico would take effect as scheduled at midnight on Tuesday, March 4. The tariff on Chinese goods will rise to 20%, up from the 10% announced in January, and will be implemented as planned. As a result, the US dollar weakened on the day, with the most notable movement being a sharp decline against the euro. The EUR/USD pair rose by 1.1%.

The softer US dollar reflects growing expectations that the Federal Reserve will counteract the economic impact of tariffs by implementing further interest rate cuts. Market data indicates that investors are now pricing in 75 basis points of rate reductions by the December meeting, suggesting a shift from just one 25bp cut at the start of February to as many as three. US stocks took a hit, with the Dow Jones dropping 1.5%, the S&P 500 falling 1.8%, and the Nasdaq sliding 2.6%. The S&P 500 is now down 4.9% from recent highs, while the Nasdaq has declined 8.7%.

In contrast, foreign exchange markets reacted more cautiously, as investors grew concerned about the impact on US economic growth, particularly given recent signs of weakness in economic data. Overnight, the US ISM manufacturing index for March came in at 50.3, down from 50.9 the previous month and below the forecast of 50.6. Additionally, US retail sales and consumer confidence figures have recently fallen short of expectations.

US Dollar in Focus as Markets Await Key Economic Data

The US dollar remains in the spotlight as markets digest the impact of new tariffs and turn their attention to key economic indicators. Later this week, the release of US non-farm payroll data will be closely watched. Job growth is expected to rise slightly, with an estimated 185,000 new jobs added in February.

January’s weaker figures were partly due to unusually cold weather and wildfires, which could lead to a rebound in this report. However, leading indicators suggest a potential underlying slowdown, and we expect employment growth to moderate in the coming months.

Additionally, President Trump’s federal hiring freeze may have contributed to a decline in government employment, which is projected to have fallen to 15,000 for the month. Meanwhile, the unemployment rate is expected to hold steady at 4.0%, with both layoffs and hiring remaining low.

Euro and British Pound Strengthen Amid Tariff Exemptions

The euro and British pound outperformed overnight, as markets responded positively to the perception that Europe and the UK have, for now, avoided US tariffs.

Today, the UK BRC shop pricing index will be released. Over the past six months (August 2024–January 2025), BRC shop price inflation has remained negative. However, in January, the rate of deflation eased to -0.7% year over year. Historically, non-seasonally adjusted prices tend to rise by 0.4% month over month in February. If this trend continues, the annual deflation rate would remain at -0.7%.

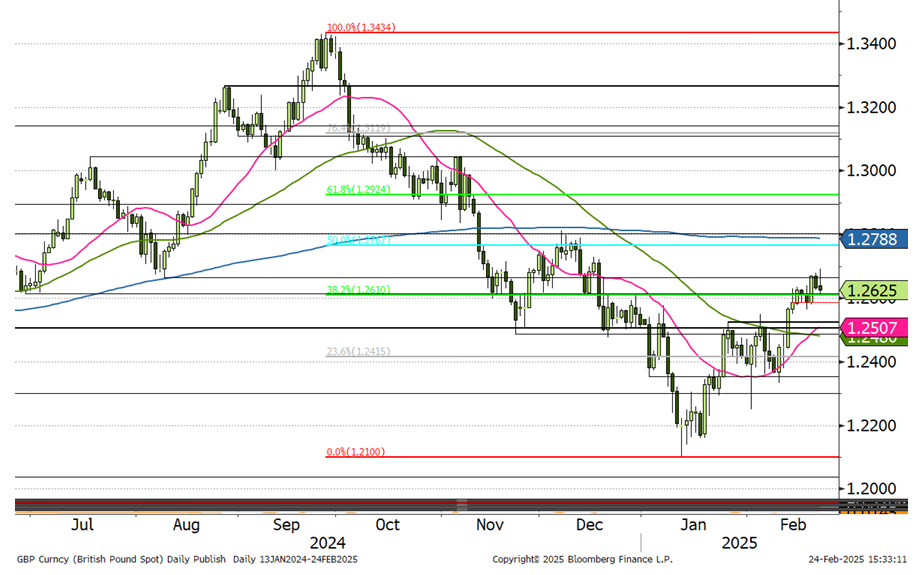

The British pound has shown resilience amid recent tariff developments, with GBP/USD reaching a two-month high overnight. The GBP has also strengthened across APAC markets.